The legal ecosystem is fundamentally changing, with the big four accounting firms growing their legal practices, law companies expanding, and legal tech investments hitting $1 billion. Seyfarth Shaw’s J. Stephen Poor advises Big Law on ways to embrace the changes and use them to better serve clients.

One of the more interesting Big Law developments over the past few years is the fundamental change in the legal ecosystem.

Pundits continue to debate the extent of change emerging or needing to emerge in Big Law. While that debate rages, the ecosystem in which Big Law competes has become structurally different.

A few examples:

- The Big Four continue to grow their legal practices. Recently, KPMG took 130 lawyers from French firm Fidal. Deloitte opened an office in Hong Kong with 25 lawyers. PwC made a number of similar moves last year. EY bought Riverview Law last year and is growing its reach.

- So-called law companies continue to expand their businesses. Elevate made several acquisitions last year. UnitedLex made a number of headline deals with both law firms and corporate buyers. Entities like Lawyers on Demand and Axiom continued to grow.

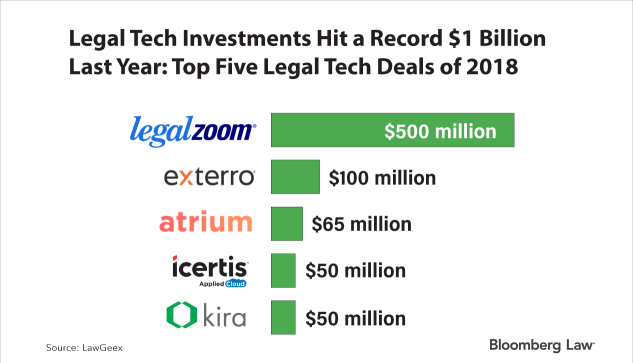

- On the legal tech front, investments hit $1 billion last year. Granted, half of this investment went to Legal Zoom, but it still remains a sizeable sum. While the killer app remains elusive, the work to apply emerging technologies to the delivery of legal services continues to accelerate.

For Big Law, it is tempting to minimize the impact of this change. After all, by comparison, the players are relatively small. None of the law companies have legal revenues rivaling AmLaw 100 firms, for example.

While Big Four lawyer numbers are whopping, their attributed revenue to the sector is more modest. Similarly, while there is no denying that $1 billion of investment is a big number, it is still much smaller that investment levels in other sectors. Moreover, the strength of financial results for Big Law in 2018 are hardly indicative of an industry in financial distress.

Increasingly Sophisticated Buyers

The key is to understand this fundamental change through the eyes of purchasers of legal services. Driven by the growth in the legal operations profession, buyers of legal services have become increasingly sophisticated in how they assemble their legal supply chain.

They are ever more capable of navigating a larger suite of options. In fact, a recent Thomson Reuters report found that 74 percent of corporations are now using alternative legal service providers (up substantially in a couple of years).

The Big Four and alternative service providers are certainly banking on it. In the words of Cornelius Grossmann, EY’s Global Law Leader: “Clients want to be able to turn to a provider who has solutions to several aspects of their problems.”

For Big Law, it may be enticing to interpret this as a return to the “one-stop shop.” After all, for many years, the mantra for success for Big Law was size—more practice groups, more offices—more is better. In essence, being all things in all places for the client. Enticing, perhaps, but using that definition would be fundamentally wrong.

The Grossmann quote is interesting because of the precise terms he uses: “providers” with “solutions” to several aspects of “problems.” At no point does he say “legal”—even though he runs EY’s legal unit of over 2,200 lawyers world-wide.

As corporate purchasers have become more sophisticated over the years, they increasingly view the problems presented by their internal clients as business problems that need to be solved—either on a substantive level or on a cost level.

Opportunity for Growth

The historic rigidity of Big Law in viewing problems solely through the lens of case cites and/or failing to deliver on alternative delivery mechanisms has led clients to look for alternatives. This, in turn, created the opportunity for the growth of this diverse ecosystem.

That is the reality today. This leaves Big Law with choices. On one extreme, firms could simply ignore this change. As noted, the players remain comparatively small and the financial performance of Big Law generally was quite strong.

Moreover, responding to this change is hard—particularly when your constituents are law partners. Nevertheless, firms that simply follow business as usual do so at their own peril.

The Big Four have a huge capital advantage and experience in multidisciplinary delivery. Combined with other alternative service providers, the path has been an upward trajectory—even during a strong overall economic environment. What happens, for example, when there is another business downturn?

Building Consulting Practices

Firms could also choose the other extreme—to go head-to-head as a diversified service provider. Sam Skolnik of Bloomberg wrote an informative article about the number of firms building various consulting practices.

Some firms may have the capital resources and partner tolerance to do precisely that. One of the most interesting examples of this diversification is Allen & Overy, a Magic Circle firm that has been on a fascinating journey over the past few years. While continuing to offer high-level expertise, the firm has added managed services, alternative tech solutions, and even a partnership with Deloitte (on their Margin Matrix product).

This is one of the clearest examples of a firm that believes that diversification means not just subject matter expertise, but various service delivery models and multi-disciplinary solutions to business problems.

That level of capital investment and partner tolerance is difficult for most firms. They may add a chief innovation officer or present a few different services, but the breadth of change like that at Allen & Overy is difficult to achieve. That means that is increasingly important for firms to be strategic about where they fit in this diverse ecosystem. For most firms—and most partners—there is an opportunity to build upon their current role as trusted advisor to companies by using the increasingly complex ecosystem to their advantage.

Today, as Grossmann noted, more and more companies are looking to providers to provide solutions to their problems. Knowing how to help a company find that solution—even if the provider is outside the four walls of the law firm—will only solidify your position with the client. Don’t ignore the complexity—it will not go away.

Embrace it.

Understand it.

And, above all, use it to help your client.

Author Information

J. Stephen Poor is chair emeritus of Seyfarth Shaw LLP, serving as an advisor to the firm’s leadership and as an executive sponsor of strategic initiatives focused on innovation and growth. He served as chair of the firm from 2001 -- 2016, leading the transformation of Seyfarth into an international law firm at the forefront of innovation.

Learn more about Bloomberg Law or Log In to keep reading:

Learn About Bloomberg Law

AI-powered legal analytics, workflow tools and premium legal & business news.

Already a subscriber?

Log in to keep reading or access research tools.